The National Association of Realtors today released Existing Home Sales data for March 2010.

From the release:

Buyers responding to the homebuyer tax credit and favorable affordability conditions boosted existing-home sales in March, marking the beginning of an expected spring surge, according to the National Association of Realtors.

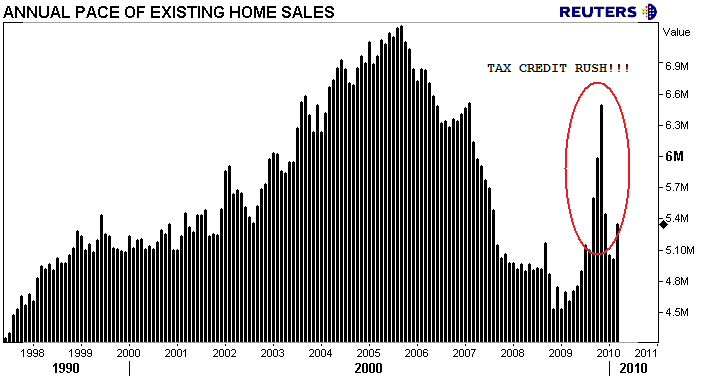

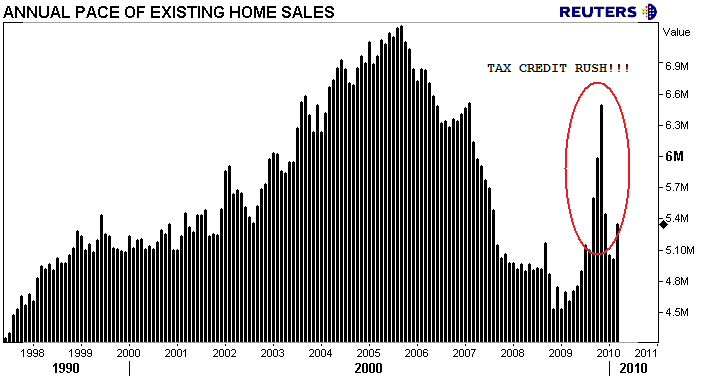

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 6.8 percent to a seasonally adjusted annual rate of 5.35 million units in March from 5.01 million in February, and are 16.1 percent above the 4.61 million-unit level in March 2009.

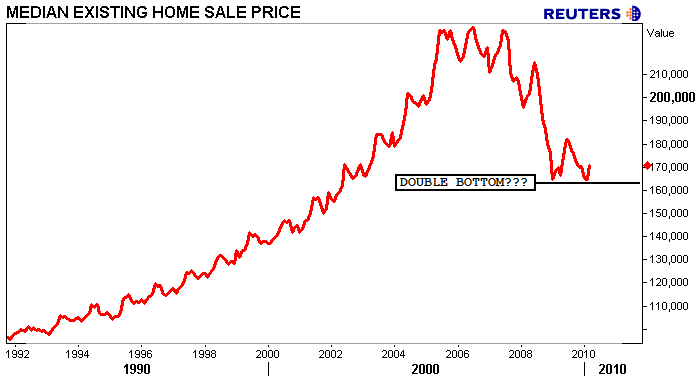

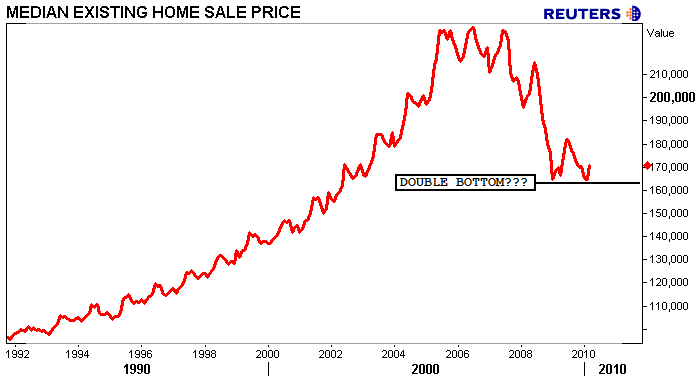

Single-family home sales rose 7.3 percent to a seasonally adjusted annual rate of 4.68 million in March from a level of 4.36 million in February, and are 13.3 percent above the 4.13 million level a year ago. The median existing single-family home price was $170,700 in March, up 0.6 percent from March 2009.

Existing condominium and co-op sales increased 3.1 percent to a seasonally adjusted annual rate of 670,000 in March from 650,000 in February, and are 39.3 percent higher than the 481,000-unit level in March 2009. The median existing condo price5 was $170,600 in March, which is 0.7 percent below a year ago.

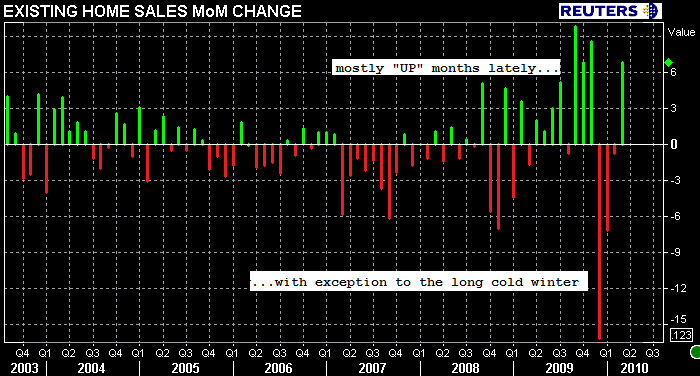

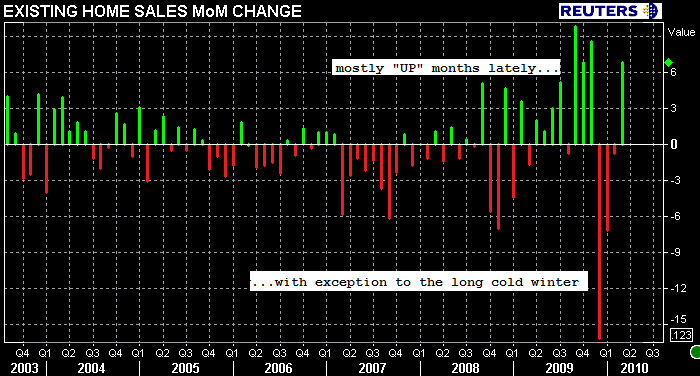

The chart below illustrates a pick up in home buyer demand during the spring/summer/early fall months of 2009, which happens to coincide with the expiration of the original first time homebuyer tax credit, followed by a drastic decline in the winter months all the way into spring 2010.

Single-family median prices rose in 14 out of 20 metropolitan statistical areas reported in March in comparison with a year earlier. Five metro areas experienced double-digit increases, including San Diego, St. Louis and Boston.

Regionally, existing-home sales in the Northeast increased 6.0 percent to an annual level of 890,000 in March and are 25.4 percent higher than a year ago. The median price in the Northeast was $249,800, up 8.9 percent from March 2009.

Existing-home sales in the Midwest rose 7.2 percent in March to a pace of 1.19 million and are 15.5 percent above March 2009. The median price in the Midwest was $139,300, up 0.2 percent from a year ago.

In the South, existing-home sales increased 7.1 percent to an annual level of 1.97 million in March and are 13.9 percent higher than a year ago. The median price in the South was $154,800, up 5.2 percent from March 2009.

Existing-home sales in the West rose 6.6 percent to an annual rate of 1.30 million in March and are 14.0 percent above March 2009. The median price in the West was $209,400, down 7.9 percent from a year ago.

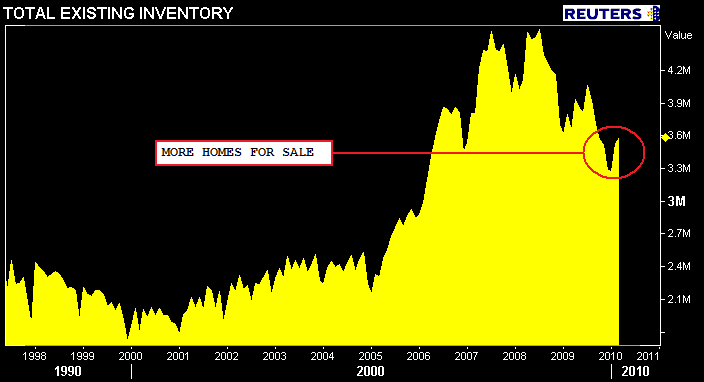

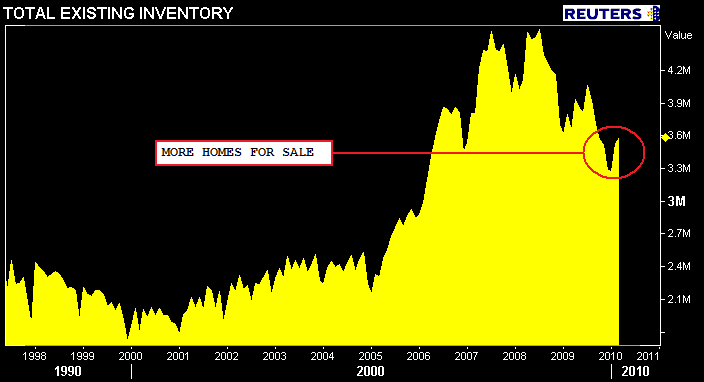

Total housing inventory at the end of March rose 1.5 percent to 3.58 million existing homes available for sale. Raw unsold inventory is 1.8 percent below a year ago, and is 21.7 percent below the record of 4.58 million in July 2008.

This represents an 8.0-month supply at the current sales pace, down from an 8.5-month supply in February.

REMEMBER: The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. See comments on chart....

Lawrence Yun, NAR chief economist, said it is encouraging to see a broad home sales recovery in nearly every part of the country, with two important underlying trends. “Sales have been above year-ago levels for nine straight months, and inventory has trended down from year-ago levels for 20 months running,” he said.

“The home buyer tax credit has been a resounding success as these underlying trends point to a broad stabilization in home prices. This is preserving perhaps $1 trillion in largely middle class housing wealth that may have been wiped out without the housing stimulus measure.”

“Foreclosures have been feeding into the inventory pipeline at a fairly steady pace and are being absorbed manageably,” Yun said. “In fact, foreclosures are selling quickly, especially in the lower price ranges that are attractive to first-time home buyers.”

“With home values stabilizing, a revival in home buying confidence will likely help the housing market get back on its feet even as the tax credit impact disappears,” Yun said.

From the release:

Buyers responding to the homebuyer tax credit and favorable affordability conditions boosted existing-home sales in March, marking the beginning of an expected spring surge, according to the National Association of Realtors.

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 6.8 percent to a seasonally adjusted annual rate of 5.35 million units in March from 5.01 million in February, and are 16.1 percent above the 4.61 million-unit level in March 2009.

Single-family home sales rose 7.3 percent to a seasonally adjusted annual rate of 4.68 million in March from a level of 4.36 million in February, and are 13.3 percent above the 4.13 million level a year ago. The median existing single-family home price was $170,700 in March, up 0.6 percent from March 2009.

The chart below illustrates a pick up in home buyer demand during the spring/summer/early fall months of 2009, which happens to coincide with the expiration of the original first time homebuyer tax credit, followed by a drastic decline in the winter months all the way into spring 2010.

Single-family median prices rose in 14 out of 20 metropolitan statistical areas reported in March in comparison with a year earlier. Five metro areas experienced double-digit increases, including San Diego, St. Louis and Boston.

Regionally, existing-home sales in the Northeast increased 6.0 percent to an annual level of 890,000 in March and are 25.4 percent higher than a year ago. The median price in the Northeast was $249,800, up 8.9 percent from March 2009.

Existing-home sales in the Midwest rose 7.2 percent in March to a pace of 1.19 million and are 15.5 percent above March 2009. The median price in the Midwest was $139,300, up 0.2 percent from a year ago.

In the South, existing-home sales increased 7.1 percent to an annual level of 1.97 million in March and are 13.9 percent higher than a year ago. The median price in the South was $154,800, up 5.2 percent from March 2009.

Existing-home sales in the West rose 6.6 percent to an annual rate of 1.30 million in March and are 14.0 percent above March 2009. The median price in the West was $209,400, down 7.9 percent from a year ago.

Total housing inventory at the end of March rose 1.5 percent to 3.58 million existing homes available for sale. Raw unsold inventory is 1.8 percent below a year ago, and is 21.7 percent below the record of 4.58 million in July 2008.

This represents an 8.0-month supply at the current sales pace, down from an 8.5-month supply in February.

REMEMBER: The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. See comments on chart....

Lawrence Yun, NAR chief economist, said it is encouraging to see a broad home sales recovery in nearly every part of the country, with two important underlying trends. “Sales have been above year-ago levels for nine straight months, and inventory has trended down from year-ago levels for 20 months running,” he said.

“The home buyer tax credit has been a resounding success as these underlying trends point to a broad stabilization in home prices. This is preserving perhaps $1 trillion in largely middle class housing wealth that may have been wiped out without the housing stimulus measure.”

“Foreclosures have been feeding into the inventory pipeline at a fairly steady pace and are being absorbed manageably,” Yun said. “In fact, foreclosures are selling quickly, especially in the lower price ranges that are attractive to first-time home buyers.”

“With home values stabilizing, a revival in home buying confidence will likely help the housing market get back on its feet even as the tax credit impact disappears,” Yun said.

No comments:

Post a Comment